Life is G!

Gcash has been part of day-to-day life of many Filipinos today and became more popular after the COVID-19 pandemic. Who doesn't like the hassle-free service where you can manage, send and receive money using ONLY your mobile phone?

There's no doubt that someone like me and other people are happy to have Gcash without the need to open a bank account!

In this guide, I will show you how to register, how to verify and how to use your Gcash account.

Loading...

How can I create a GCash account?

Turn your mobile phone into a secure virtual wallet when you register for a GCash account. Instantly pay bills, buy load, send money, shop, and more--all in the safety of your own home!

You can register through any of the following:

- GCash App

- *143# (USSD) for Globe/TM subscribers

Register via the GCash App

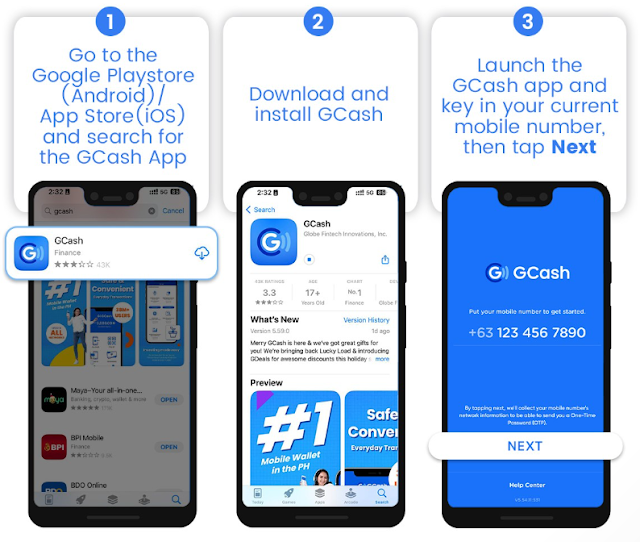

STEP 1: Go to the Playstore/App Store and search for the GCash App.

STEP 2: Download and install GCash.

STEP 3: Launch the GCash app and key in your current mobile number, then tap Next.

STEP 4: Enter the 6-digit Authentication Code sent to your mobile number, then tap Submit.

- Tap Resend Now if you didn’t get the code.

STEP 5: Answer the required fields with your correct information, then tap Next.

STEP 6: Review your answers, then tap Next.

- Tap the "Back App Arrow" button to edit your information.

- If you have a referral code, tap the dropdown and enter the code.

STEP 7: Set and confirm your MPIN, then tap Submit.

- Avoid easily guessable MPINs like your birthday, 1234, or the last four digits of your phone number.

STEP 9: On your first login attempt, enter the 6-digit Authentication Code sent to your registered mobile number for device authentication.

- You may need to authenticate your device again after 90 days. When that happens, enter the new code on the app for re-authentication.

- Confirmation screen will be displayed. Log in with your MPIN.

Here is a summary of how to create a GCash account:

Register via *143# (USSD)

NOTE: This process is only available to Philippine-issued SIM.

STEP 1: Dial *143#.

STEP 2: Enter the option for GCash, then tap Send.

STEP 3: Enter the option for Register, then tap Send.

STEP 4: Set and verify your MPIN.

Tip: Avoid easily guessable MPINs like your birthday, 1234, or the last four digits of your phone number.

STEP 5: Provide your information as prompted.

Tip: If you entered an email address, key in 1 to confirm or 2 to go back.

STEP 6: Enter the option for Register.

STEP 7: A confirmation screen will be displayed.

STEP 8: Download and install the GCash App.

HELPFUL ITEMS YOU CAN USE TO SAVE MONEY!

Here's my list of useful items for you to save or earn money wisely:

- Coin banks

- Informative books about money, saving and investments!

- Money organizer

Shopee is my go-to app for things I needed like the ones above. If you'd like discounts and vouchers, you may get the best offers here:

How do I get Fully Verified?

Verifying your GCash opens up a lot of benefits in using your GCash app such as:

- Access all GCash features and services

- Increased wallet and transaction limits

- Secures you and the people you transact with

Access all GCash features and services

Here are the additional GCash features and services you can enjoy when you fully verify your account:

Increased wallet and transaction limits

When you undergo full verification, your wallet limit increases to P100,000, which means you will be able to keep up to P100,000 in your GCash wallet at any given time. READ: How to Increase GCash Wallet and Transaction Limits

Secures you and the people you transact with

Transacting with fully verified users is more secure because:

- GCash has a copy of valid documents proving the legitimacy of the user’s identity

- Users provide personal information to support proof of their identity

- Users take a selfie scan which proves that they are human and not a bot

Here’s how you verify your account

Prepare a valid (not expired) government ID that you have on hand.

Here's a list of recommended IDs to submit to immediately get verified:

- Driver's License

- Passport

- Philhealth Card

- UMID

- Voter's ID

- SSS ID

- PRC ID

- Postal ID

Tips on how to choose the right ID for your application:

- Your ID must be valid (not expired) with a validity period indicated on your ID

- The name on your ID must match the name on your GCash account

- Your ID must have an ID number

- The ID must be laminated if it is a paper type

- Your ID must have your signature

- ID must be in good physical condition and not tampered

To learn more about the accepted IDs for Verification, go to What are the IDs I can submit to get verified?

Prepare to take a selfie

Follow these steps to fully verify your GCash account:

STEP 1: Launch the GCash App

STEP 2: Tap the Profile icon on the bottom right of the screen

STEP 3: Tap Verify Now below your name

STEP 4: Tap Get Verified

STEP 5: Choose from the list a valid (not expired) government ID that you have on hand

Reminder: Make sure to choose the correct ID type, if the photo of the ID you choose to take photos of doesn't match the ID type selected in this step, your application will be rejected.

The following IDs will not be accepted

- Barangay ID

- TIN ID

- School ID

- Company ID

STEP 6: Take photos of the valid government ID that you chose

- Make sure the information is clear and readable.

- If you will submit your Alien Certificate of Registration (ACR), you will need to take a picture of the front and back of your ID.

- Not satisfied with the photo of your ID? Tap Retake to get a better quality photo.

STEP 7: Tap Submit

STEP 8: Read the guidelines on how to properly take a photo of yourself then tap Next

To verify your identity, you will need to take a photo of yourself through a selfie scan.

STEP 9: Take a selfie scan

- Position your face within the frame, then wait for the camera to scan your face. Blink when instructed.

- Make sure your photo comes out clear.

- Not satisfied with your photo? Tap Retake to get a better quality photo.

STEP 10: Fill up the form with the required information

Fill up the form with correct information to avoid being rejected due to inconsistent details.

STEP 11: Tap Next

STEP 12: Review your information

Ensure that the details provided are correct and accurate such as your ID Type, ID Number, name, birth date, and address to avoid rejection.

To change details, you can go back and edit the form by tapping the arrow on the upper left corner.

STEP 13: Read the Terms and Conditions and tick the box to state that you agree to the Terms and Conditions. Tap Confirm to submit your application.

You will see a confirmation screen that your application has been submitted. Check the confirmation screen to know how long it will take for us to review your application.

Here’s a summary on how to fully verify your GCash account:

How to Cash-In to GCash (and Cash-Out)

There are several ways to Cash-In to your GCash account. Here are some of the most commonly used cash-in options:

- Cash In via Banks in GCash (BPI, UnionBank)

- Cash In via PayPal, Payoneer

- Cash In via International Remittance

- Cash In via Over-The-Counter

- Cash In via 7-Eleven CLiQQ

Is there a fee to Cash In?

Certain fees apply to specific methods of cashing in in GCash. Tap or click on your preferred cash in method below to learn more about the fees for cashing in. (See complete list of possible fees from GCash)

Cash In via Online Banking

Cashing in is free of charge for the following cash in channels:

- BPI

- UnionBank

You can also cash in from your preferred bank’s website or app using InstaPay. GCash today is partnered with 40+ banks.

Partnered banks that use InstaPay may incur service fees that vary per bank. To know more about your preferred bank’s service fee, go to list of bank Apps that use InstaPay.

Cashing in via PayPal is also free of charge.

Where can I Cash Out?

You can cash out at any BancNet and/or MasterCard affiliated ATM or at any GCash Partner Outlet.

Simply look for the logo of either Mastercard or BancNet on the ATM.

![]()

You can also cash out from any of the following GCash Partner outlets:

- Cebuana Lhuillier

- CVM Pawnshop

- DA5

- ECPay

- ExpressPay

- HanepBuhay

- Jaro Pawnshop

- Panalo Express

- PeraHUB

- Posible

- Puregold

- Robinsons

- SM Store

- Tambunting Pawnshop

- TrueMoney

- Villarica Pawnshop

- VIP Payments Center

Each Partner Outlet has its own cash out steps. You can view these via the GCash App.

OTHERGCASH HELPFUL TIPS

ABOUT GCASH

GCash is a Philippine mobile wallet, mobile payments and branchless banking service. Introduced in 2004, it is owned by Mynt (formerly Globe Fintech Innovations), which is a joint venture between Ant Group, an affiliate company of the Alibaba Group and the operator of the world's leading open digital lifestyle platform, Alipay; Ayala Group of Companies, one of the Philippines' largest business conglomerates; and Globe Telecom, one of the Philippines' largest telecommunications companies (on Globe's side, GCash is under 917Ventures).

As of 2019, it had 20 million active users and more than 63,000 partner merchants in the Philippines. However, in two years, owing to the rise of digital payments in the Philippines due to the COVID-19 pandemic, these figures more than doubled, with 46 million active users and 2.5 million merchants and sellers as of August 2021, making GCash the country's undisputed mobile wallet giant.

Acknowledgement: This article is sponsored by Usapang Hanapbuhay.

Bisitahin ang Usapang Hanapbuhay Facebook Group para sa iba pang tips at mga diskarte sa pera!

gcash login gcash register gcash app for pc gcash account gcash login pc gcash login without app how to use gcash gcash logo create gcash account how to create gcash account how to register gcash how to make gcash account gcash sign up gcash create account gcash register gcash register new account gcash-registered mobile number how to register in gcash how to make a gcash account how to open gcash account gcash register 2023 how to register to gcash how to create new gcash account what email address did you use to register to gcash how to create gcash register gcash number create new gcash account how to register gcash account how to create a gcash account how to apply gcash how to make gcash register gcash account how to have gcash

No comments

Let us know your thoughts!