The Bank of the Philippine Islands, better known as BPI, is one of the largest, most profitable banks in the country.

Whether it’s your first credit card or not, applying for a BPI credit card is always a good decision. Aside from being reputable and reliable, they are also known for giving out exciting rewards and programs to their loyal cardholders.

Loading...

So, if you’re planning to get a card, we can help you choose the right BPI credit card for you. Here's the list of BPI Credit Card available for online application:

BPI Visa Signature Card

Experience the best of what the world has to offer with the card that complements your Signature lifestyle.

Pros

- Earn points faster! Php 20 spend = 1 Real Thrills Rewards Premium point

- 50% off Signature deals year round

- Special rates on foreign currencies

- Free travel insurance up to Php 20 Mn

- 24/7 Visa Worldwide Concierge

- Exclusive Visa Global Services

- Low forex conversion rate of 1.85%

- Free membership to Ayala Rewards Circle

- Free Global Airport Lounge Access (coming soon)

- Free Annual Membership Fee for 3 years for Preferred Clients

BPI Platinum Rewards Mastercard

Elevate to a platinum rewards experience like no other.

Pros

- Php 30 local spend or Php 20 spend on any foreign transaction online and abroad = 1 Real Thrills Rewards Premium point

- All-year-round Real 0% Installment on airline tickets up to 6 months

- Free Priority Pass membership for global airport lounge access, with up to 4 free passes

- Free travel insurance of up to Php 10 Mn

- Purchase Protection up to 180 days

- Access to Mastercard® Travel and Lifestyle Services

BPI Family Credit Card

This BPI card is designed for those who do not want to deal with high annual fees as this card offers lower fee compared to its counterparts. Its affordable fees make it easier for people to manage cards.

Pros

- Low finance charge

- Zero monthly installment feature

Cons

- Limited cash advance

- Annual fee waived for the first year only

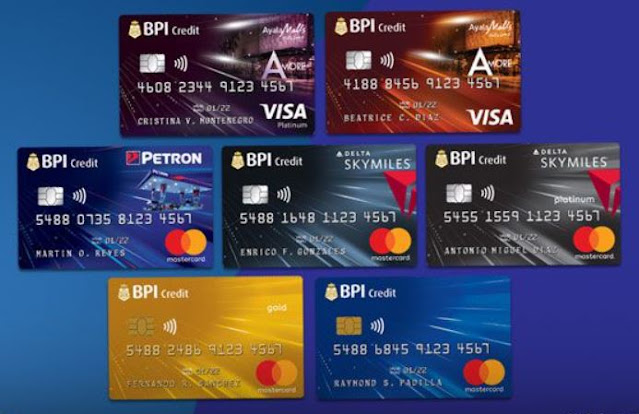

BPI Amore Visa

BPI Amore Visa allows you to avail members only mall perks and privileges. Plus, you can enjoy up to 4% rebates to any participating Ayala Malls.

Pros

- Exclusive rewards from Ayala Malls

- Cinema tickets discount

Cons

- Most of its benefits revolve around shopping and may not suit other preferences

- High-interest rate of 3.50%

BPI Amore Visa Platinum

If you are looking for a card that enables you to avail several shopping rewards, BPI Amore Visa Platinum is the right card for you. Earn cash rebates every time you shop using this card.

Pros

- Unlimited shopping perks and privileges

- Cash rebates up to 4%

Cons

- High annual fee of P5,000

- High monthly income requirement: P200,000

BPI Edge Mastercard

Upgrade your style with BPI Edge Mastercard. This card provides you with several discounts and freebies from your favorite stores.

Pros

- A low annual fee of P1,320

- Low monthly income requirement: P15,000

Cons

- High-interest rate of 3.50%

HELPFUL ITEMS YOU CAN USE TO SAVE MONEY!

Here's my list of useful items for you to save or earn money wisely:

- Coin banks

- Informative books about money, saving and investments!

- Money organizer

Shopee is my go-to app for things I needed like the ones above. If you'd like discounts and vouchers, you may get the best offers here:

BPI Blue Mastercard

Looking for a card that you can use across the globe? Opt for BPI Blue Mastercard. Its reward system will let you fly to your dream destination.

Pros

- A low annual fee of P1,550

- Free travel insurance up to P2M

Cons

- Limited cash advance

- Only first supplementary cardholders have waived annual fee for life

BPI Gold Mastercard

BPI Gold Mastercard is the ideal card for those who want to maximize the cash advance feature. Plus, this card allows you to earn rewards for every purchase.

Pros

100% cash advance of your limit

Free travel insurance up to P10M

Cons

- High-interest rate of 3.50%

- High minimum monthly income requirement: P40,000

Petron – BPi Mastercard

Especially designed for motorists, Petron – BPI Mastercard rewards its cardholders with free full tank every year and exclusive privileges at Petron stations.

Pros

- A fuel rebates

- Discounts at participating Petron stations

Cons

- High finance charge of 3.50%

- Most features cater for motorists and may not suit another lifestyle

BPI SkyMiles Mastercard

Created for travelers, BPI SkyMiles Mastercard enables its cardholers to earn miles every time they spend.

Pros

- Free travel insurance up to 10M

- Non-expiry SkyMiles points

Cons

- High-interest rate of 3.50%

BPI SkyMiles Platinum Mastercard

BPI SkyMiles Platinum Mastercard is the best option for those frequent flyers as this card provides double miles for every spend on Delta Air Lines.

Pros

Earn miles for every spend

Get free travel insurance up to P20M

Cons

- High annual fee of P5,000

- High minimum annual income of P1M

Extension Card: BPI eCredit

The BPI Credit MasterCards come with free extension upon request. Those who would opt for the free BPI eCredit companion card will have more security for online payments. It has its own set of a lower credit limit, and a different card number to avoid fraud. It also comes with free for life annual fee.

BPI Credit Card Eligibility

Check your eligibility. Make sure you meet BPI’s cardholder qualifications and have their document requirements available.

- Valid age for applicants is between 21 to 60 years old

- Applicants must meet the minimum monthly income requirements for the following BPI credit cards. Over time, commissions, or service fees are not included:

- P15,000 — BPI Blue Mastercard, Petron-BPI Mastercard, BPI SkyMiles Mastercard, BPI Amore Visa Card, and BPI Edge Mastercard

- P40,000 — BPI Gold MasterCard

- P80,000 — BPI Amore Visa Platinum Card, BPI SkyMiles Platinum Mastercard

- P30,000 — OFWs and Self-employed

- Residence or business contact number

For list of requirements for BPI Credit Card Application, visit BPI CREDIT CARD REQUIREMENTS.

Acknowledgement: This article is sponsored by Usapang Hanapbuhay.

Bisitahin ang Usapang Hanapbuhay Facebook Group para sa iba pang tips at mga diskarte sa pera!

bpi credit card online types of bpi credit card bpi credit card hotline bpi credit card delivery bpi credit card promo bpi credit card application bpi credit card application status bpi credit card requirements bpi credit card limit bpi visa signature bpi gold mastercard credit limit bpi ecredit card bpi credit card for beginners bpi credit card no annual fee bpi credit card requirements bpi blue mastercard

No comments

Let us know your thoughts!