Here is a full list of the new monthly contribution rates of the Social Security System (SSS) effective April 2019.

In the Philippines, a lot of people are member of the Social Security System (SSS), a social insurance program under the Philippine government. Most of its members are workers of private companies.

Loading...

A lot of self-employed Filipinos are also members of the SSS. Every month, a member should pay for the contribution rate to be eligible for the benefits and coverage of the social insurance program.

Among the benefits and offers of the Social Security System are the SSS Housing Loan, SSS Death Claim, and SSS Business Loan. A member may be eligible for it by reaching the prescribed number of monthly contributions.

With regards to the rates for the monthly contribution, the social insurance program has recently released the SSS contribution rate 2019 for employed, self-employed, voluntary, and non-working spouse of members.

HELPFUL ITEMS YOU CAN USE TO SAVE MONEY!

Here's my list of useful items for you to save or earn money wisely:

- Coin banks

- Informative books about money, saving and investments!

- Money organizer

Shopee is my go-to app for things I needed like the ones above. If you'd like discounts and vouchers, you may get the best offers here:

The state-run insurance program also posted the SSS contribution rate 2019 for Household Employers and Kasambahay and as well as Overseas Filipino Worker (OFW) members.

For a more detailed list, please see table below:

Based on the official schedule posted by the Social Security System, the contribution of the non-working spouse will be based on 50% of the salary credit of his or her working partner.

With regards to the Kasambahay contribution, under the Kasambahay Law, the employer should be the one to pay for the whole monthly contribution of the worker if the latter’s salary is below Php 5,000.00.

There is a proposed bill to increase contribution from 11% to 12.5%. Maximum salary credit is also set to increase to P20,000 if the bill passes. For the meantime, the prevailing rate of 11% is still applicable.

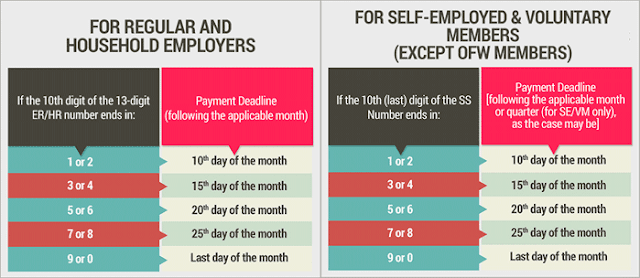

SSS is imposing penalties to late payments so make sure to pay on time to the SSS Office or their designated payment centers. Also, make sure that your employer is paying for your SSS on time.

Acknowledgement: This article is sponsored by Usapang Hanapbuhay.

Bisitahin ang Usapang Hanapbuhay Facebook Group para sa iba pang tips at mga diskarte sa pera!

sss contribution table 2022 sss contribution voluntary sss contribution table 2023 sss contribution table 2022 self-employed sss contribution table 2022 pdf sss contribution table 2022 excel file sss contribution payment how much is sss contribution for unemployed

No comments

Let us know your thoughts!