Looking for ways to grow your hard-earned money? What if we told you there’s a local bank that offers 5.00% per annum interest? Say hello to the SeaBank Peso savings account!

SeaBank is a rural bank with digital banking features. It means you can open a savings account without visiting a branch. Let’s take a closer look at the fees, interest rates, and key benefits, and find out if it’s worth opening an account.

Loading...

SeaBank Philippines, Inc. (A Rural Bank)

SeaBank, offered by SeaBank Philippines, Inc. (A Rural Bank) is a mobile banking application that enables you to manage your finances seamlessly on your mobile phone, anytime and anywhere. You can send and receive transactions from both SeaBank and non-SeaBank users, all while earning competitive interest rates with no additional fees and no minimum balance.

SeaBank Peso savings account features

By using the SeaBank app, you can perform financial transactions such as depositing money and fund transfer. Here are other features of the digital banking app:

- Your account is free (NO fees to open)

- Competitive interest rates

- Daily payout of interest earnings

- Free transfers (InstaPay and PESONet)

- Sign up easily with 1 valid ID

- No minimum balance is required

- No lock-in period

- No deposit cap

HELPFUL ITEMS YOU CAN USE TO SAVE MONEY!

Here's my list of useful items for you to save or earn money wisely:

- Coin banks

- Informative books about money, saving and investments!

- Money organizer

Shopee is my go-to app for things I needed like the ones above. If you'd like discounts and vouchers, you may get the best offers here:

SeaBank Peso savings account interest rate vs. other banks

SeaBank offers 5.00% interest per annum, and earnings are credited daily. There’s no maximum deposit, but there’s a daily limit of up to ₱1 million on outgoing transactions like sending money from SeaBank to other local banks. For incoming transfers to your SeaBank account, there’s no limit.

For example, you can receive ₱5 million from a local bank straight to your SeaBank account. But you can only transfer to other local banks and e-wallets up to ₱1 million. The savings account is straightforward. If you save more, then you earn more. The total interest earnings are calculated based on the depositor’s available balance, net of tax deductions.

According to SeaBank’s calculator, here’s how much interest you will earn. Your earnings are subject to 20% withholding tax.

To compare SeaBank to other digital savings, read - Top Digital Savings Banks in the Philippines (CIMB, Maya, Tonik, SeaBank and More!)

What are the requirements to open a SeaBank account?

Opening an account is pretty straightforward. Download the SeaBank app to your mobile device and follow the instructions. The quickest way to do it is to register via a Shopee account. Simply link your account, and the mobile app will walk you through the verification process.

You may open an account if you’re...

- 18 years old and above

- A resident of the Philippines

- One (1) government-issued ID (e.g., driver’s license, passport, Unified Multipurpose ID)

- One (1) document as proof of address (e.g., recent utility bill, credit card statement, certification of voter’s registration, driver’s license, condominium dues bill)

How to sign up for SeaBank Philippines online?

You can easily open an account in the SeaBank app in three easy steps:

STEP 1. Download the SeaBank app from the Apple App Store, Google Play Store, or Huawei AppGallery.

STEP 2. Register for a SeaBank account by following the steps below:

There are three options to sign-up:

- To register with Mobile Number, tap "Sign-up with Mobile Number".

- To register with Shopee, tap "Continue with Shopee".

- to register with Apple, tap "Continue with Apple".

STEP 3. Create your password

STEP 4. Undergo Facial Verification

RELATED GUIDE: Here's How to Order a SeaBank Debit Card in the Philippines

ATTRACTIONS TO SEE IN MANILA

Klook.comSTEP 5. Upload your ID (Prepare any of the following valid IDs: UMID, Driver’s License, PhilID (National ID), Postal ID, Passport, PRC ID, or SSS ID)

STEP 6. Fill in your personal information

STEP 7. Create your Secure PIN

STEP 8. Receive confirmation of successful application via an in-app notification, email, or SMS.

ACTIVITIES AND TOURS IN MANILA

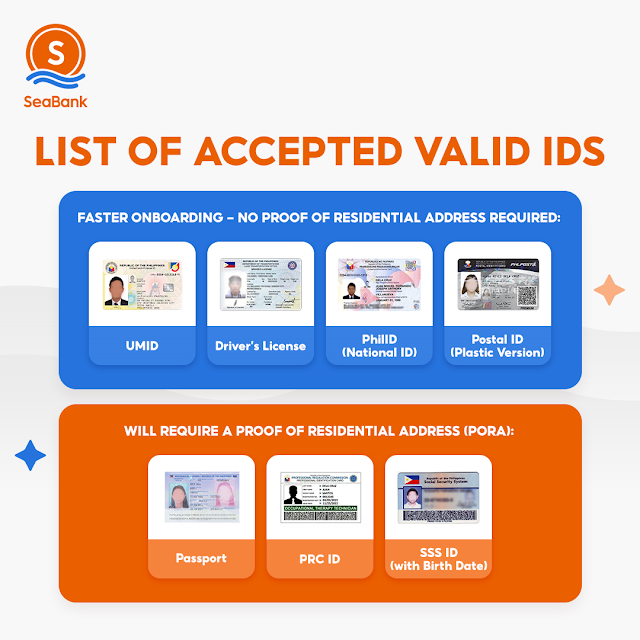

SeaBank accepted IDs

Here's a list of IDs accepted by SeaBank for opening an account:

- Unified Multi-purpose ID (UMID)

- Philippine Driver's License

- Philippine Identification Card (PhilID) or National ID

- Postal ID (plastic format)

- Philippine Passport

- Professional Regulation Commission (PRC) ID

- Social Security System (SSS) ID

Frequently Asked Questions (FAQs)

How do I check the status of my application?

You may check your application status by logging in to your SeaBank account. SeaBank will send you SMS notifications for updates on your application.

My application was rejected and I want to re-apply. What should I do to ensure that my next application will be successful?

To ensure that your next application is successful, please follow the steps below:

1. Use an acceptable valid ID. For a list of valid IDs, click here.

2. Take a clear & complete photo of your actual ID. Photos of your ID taken from a screen of another device are not accepted. Please ensure that all texts are visible, and the photo has no glares.

3. When signing up for an account, please ensure that your personal details are the same as stated on your valid ID.

4. If a Proof of Residential Address (PORA) is required, upload a clear & complete picture of your PORA; this picture should show your full name, residential address, the biller's name or logo, and an issue date in the past 3 months.

SeaBank Philippines, Inc. (A Rural Bank)

Head Office: 32 Rizal Street, Brgy. Poblacion II, Pagsanjan, Laguna

Official Website: seabank.ph

Hotline: (+632) 8891 7927 (Monday to Friday: 8 AM to 10 PM, Saturday and Sunday: 9 AM to 6 PM, excluding holidays)

Facebook: https://www.facebook.com/SeaBankPhilippines

Instagram: https://www.instagram.com/seabank.ph

Instagram: https://www.instagram.com/seabank.ph

No comments

Let us know your thoughts!